Traveling to a foreign country can be an exciting adventure, but figuring out how to pay for things can sometimes feel like navigating a maze. Whether you’re debating between cash or card, trying to avoid steep currency exchange rates, or fearing scams, this guide will help you make savvy choices. You’ll discover effective tips to ensure you always have access to your money while avoiding unnecessary fees.

With practical advice from Away Together’s video featuring Nik and Allie, you’ll get insights into the essential tools and services that can help you manage your finances abroad. Exploring topics like how to secure the best foreign currency rates and avoid common pitfalls will empower you to enjoy your travels without financial stress.

Understanding Local Payment Customs

Traveling to a new country often involves understanding the local payment customs to ensure a smooth experience. It’s essential to recognize that payment norms can vary significantly from one place to another. By researching and adapting to these practices, you’ll have a more enjoyable and less stressful journey.

Researching Country-Specific Payment Norms

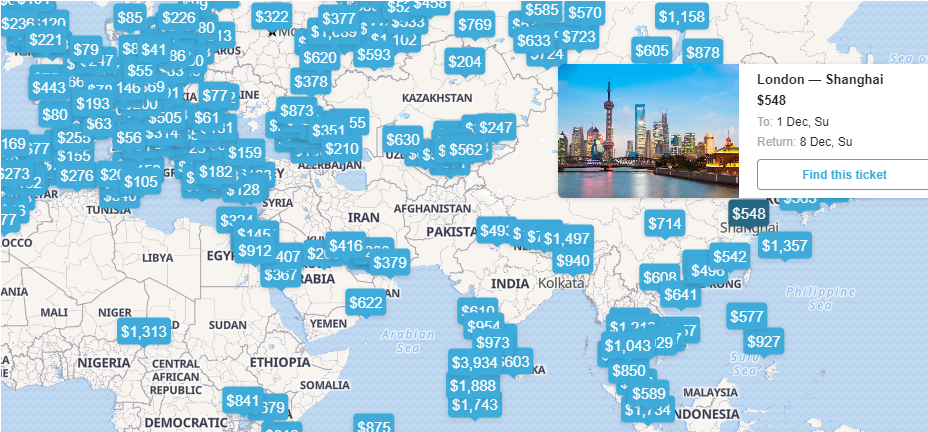

Before you pack your bags, take some time to research the country-specific payment norms of your destination. Some countries may predominantly use debit cards, while others might still rely heavily on cash. Understanding these nuances can prevent awkward situations at checkout counters. You can start by reading travel guides, visiting online forums, or consulting recent tourists’ experiences. Familiarizing yourself with payment types and the general attitude towards money will help you navigate transactions with ease.

Identifying Cash-Dominant Cultures

Certain cultures still prefer cash transactions, even in the digital age. Identifying these cash-dominant cultures will help you prepare accordingly. You might find that small vendors, food stalls, and local markets exclusively accept cash, making it vital to carry local currency. In some places, such as Japan or parts of Germany, cash remains king due to cultural preferences or privacy concerns about digital payments.

Realizing Credit Card Trends in Different Regions

While cash might be prevalent in some areas, credit card usage tends to be widespread in others. Understanding credit card trends can help you decide whether to rely more on plastic in specific regions. For example, Scandinavian countries are well-known for their cashless societies, where cards are accepted almost universally. You’ll also want to check which card networks are most widely recognized in your destination to avoid any disappointments at checkout.

Cash vs. Card: Making the Right Choice

As you embark on your travels, deciding between using cash or cards requires some strategic thinking. Both options have their advantages and drawbacks, so finding the right balance is key to managing your finances without falling into common traps.

Benefits of Using Local Currency

Using local currency has numerous benefits when you’re abroad. First and foremost, it can help you avoid foreign exchange fees that banks might impose on card transactions. Cash can also be more convenient, as some small establishments may only accept cash payments. Additionally, paying with local currency allows you to immerse yourself in the local economy, offering a more authentic experience.

When to Rely on Credit/Debit Cards

Credit and debit cards offer convenience and security when traveling. They reduce the need to carry large amounts of cash and can be ideal for larger purchases, such as hotel stays or fine dining. Many cards also offer rewards, making them a lucrative choice. However, ensure your card does not have foreign transaction fees and that your bank is aware of your travels to prevent any service disruptions.

Navigating Cash-Only Establishments

Encountering cash-only establishments can be challenging if you’re unprepared. It’s advisable to carry a small amount of local currency for such instances. Restaurants, taxis, and street vendors are often cash-only, particularly in smaller towns or rural areas. It’s helpful to get a sense of what might require cash by doing a bit of research or asking locals for advice.

This image is property of i.ytimg.com.

How to Obtain Local Currency Safely

Having some local currency at your disposal is crucial, but how do you obtain it safely? From ordering cash in advance to using ATMs, you’ll find several ways to get your hands on local currency while minimizing risks.

Ordering Foreign Cash from Your Bank

Ordering foreign currency from your bank before you embark on your journey is a straightforward option. Many banks offer this service, allowing you to obtain cash at competitive rates. This method can be particularly useful if you want peace of mind upon arrival at your destination, ensuring you have cash for your first expenses like transportation from the airport.

Using Local ATMs Effectively

Once you’ve arrived at your destination, local ATMs can be the easiest way to withdraw cash. Make sure to use ATMs associated with reputable banks, ideally during the day when security is heightened. Remember to check whether your bank charges international ATM fees and search for partnerships that may allow for free withdrawals.

Avoiding Airport Currency Exchanges

While airport currency exchanges might seem convenient, they often come with poor exchange rates and additional fees. Instead, opt for withdrawing a small amount of cash from an ATM in the airport if necessary, then head to a bank ATM in the city to get better rates for larger amounts.

Choosing the Right Financial Tools

Having the right financial tools at your disposal can make a significant difference while traveling. From fee-free cards to travel rewards and mobile wallets, choosing wisely will help streamline your payments abroad.

Checking for Cards with No Foreign Transaction Fees

A crucial aspect of selecting a travel credit card is ensuring it comes with no foreign transaction fees. These fees can add up quickly, increasing the cost of your trip. Many travel-focused credit cards waive these charges, making them ideal for frequent travelers. Check with your bank for options or consider popular travel cards available on the market.

Emphasizing the Importance of Travel Rewards Cards

Travel rewards cards can provide great perks, such as earning points on expenditures that can be redeemed for flights, hotel stays, or even cash back. Additionally, some offer travel insurance, purchase protection, or concierge services, adding value to your travel experience. Maximizing these benefits requires planning, so start by examining how to earn and use points effectively.

Setting Up Mobile Wallets for Convenience

Mobile wallets like Apple Pay, Google Pay, or Samsung Pay provide additional convenience for travelers. They allow you to carry multiple cards digitally, reducing the risk of theft. Many places, especially in tech-savvy regions, accept contactless payments through mobile wallets. Setting up these services before your trip ensures you have a backup payment method available.

Navigating ATM Transactions

When using ATMs abroad, there are some best practices to follow to ensure your transactions are secure and advantageous. Proper ATM etiquette can prevent unwanted surprises on your travel budget.

Identifying Bank-Associated ATMs

Try to locate ATMs affiliated with major banks when withdrawing money. These tend to have better security measures and might also offer more competitive exchange rates. If possible, find an ATM connected to your bank’s international network to avoid fees.

Avoiding Independent or Sketchy ATMs

It’s best to steer clear of independent ATMs or those with suspicious appearances. These machines often charge excessive fees and may pose security risks, such as card skimming. Instead, choose ATMs located inside banks or reputable stores to ensure a safer transaction.

Understanding Dynamic Currency Conversion and Rejecting It

Dynamic currency conversion allows you to see your card transaction amount in your home currency but comes with hidden fees. Always opt to pay in the local currency instead, as this typically results in a more favorable rate. Be on the lookout for this option at ATMs and during in-store transactions and decline when prompted.

Recognizing and Avoiding Scams

While navigating payments in a foreign country, being aware of potential scams is crucial. Knowing what to look out for can help you avoid falling victim to fraudulent tactics.

Common Travel Scams Aimed at Tourists

Travel scams are unfortunately common and can take many forms. Whether it’s overcharging for services, fake tour guides, or counterfeit products, staying vigilant and questioning deals that seem too good to be true can save you money and stress.

Identifying Fake Currency Exchange Booths

Fake currency exchange booths might offer enticing rates but take caution. Verify legitimacy by checking reviews or asking locals for advice. Use well-known exchange centers or recommended banks to ensure you’re getting a fair deal.

Using Trusted Platforms for Payments

For online bookings, transportation, or shopping, use trusted and well-reviewed platforms. Look for certification or trust badges on websites, and consider using payment systems that offer buyer protection, such as PayPal, to add an extra layer of security to your transactions.

Using Technology to Your Advantage

Modern technology can help navigate the complexities of dealing with foreign currency and transactions, facilitating smoother travel experiences.

Apps That Help Navigate Currency Exchange Rates

Several apps provide real-time exchange rate information, helping you make informed decisions when converting money. Tools like XE Currency and OANDA keep you updated on the latest rates, allowing you to choose the best time and place for currency exchange.

Ensuring Secure Wi-Fi Connections When Making Transactions

When making payments or managing your finances online during your travels, ensure your internet connection is secure. Use VPNs or trusted private networks to protect your information from potential cyber threats, especially when accessing sensitive banking details.

Embracing Contactless Payment Options

Contactless payment technologies provide quick and secure alternatives to cash transactions. Many countries have widely adopted these methods, allowing for smoother payments. Embrace these options where available for their convenience and safety.

Mastering Tipping Etiquette Abroad

Tipping etiquette varies widely around the globe, and understanding these customs can prevent awkward situations and known faux pas during your travels.

Research Local Tipping Customs

Before arriving, research the tipping customs of your destination. Some cultures include service charges in bills, while others consider tipping optional or even rude. Knowing these nuances will help you navigate dining out and services gracefully.

Using Apps Like GlobeTips for Accurate Tipping Advice

Apps like GlobeTips offer region-specific tipping advice, giving you the confidence to tip appropriately. These tools can guide you on expected amounts and percentages based on the service level and help you adjust to local practices effortlessly.

Adjusting Tipping Habits Based on Service Levels

Adjust your tipping habits according to how services are managed in your destination. While tipping generously can be welcomed in places like the United States, it might be unnecessary or excessive in others. Follow local cues and guidelines to align with cultural expectations.

Safeguarding Your Finances While Traveling

Keeping your finances safe is a top priority during your travels. By being proactive, you can ensure your funds are protected and enjoy your trip with peace of mind.

Keeping Track of Expenses Using Budget Apps

Budget apps like Mint or You Need a Budget (YNAB) allow you to track your spending and manage your travel budget on the go. These tools help you keep an eye on all transactions, prevent overspending, and offer real-time insights into your financial habits.

Notifying Your Bank About Travel Plans

Informing your bank about your travel plans can prevent unexpected blocks on your cards due to suspicious activity alerts. Many banks offer options to set travel notifications online or through their mobile apps, ensuring your transactions go through smoothly while traveling.

Securing Emergency Numbers for Banks and Card Providers

Have a list of emergency contacts for your banks and credit card providers in case you lose your card or become a victim of fraud. Keeping these numbers handy allows for quick action to halt transactions and resolve issues efficiently.

Conclusion

Navigating payment practices while traveling abroad requires some preparation and awareness. By understanding local customs, choosing suitable financial tools, and utilizing technology, you can make payments safely and efficiently. Remaining informed and vigilant about potential scams ensures a smoother travel experience without financial hiccups. With careful planning and attention to detail, your travels can be enjoyable and secure, focusing on creating lasting memories rather than financial worries.

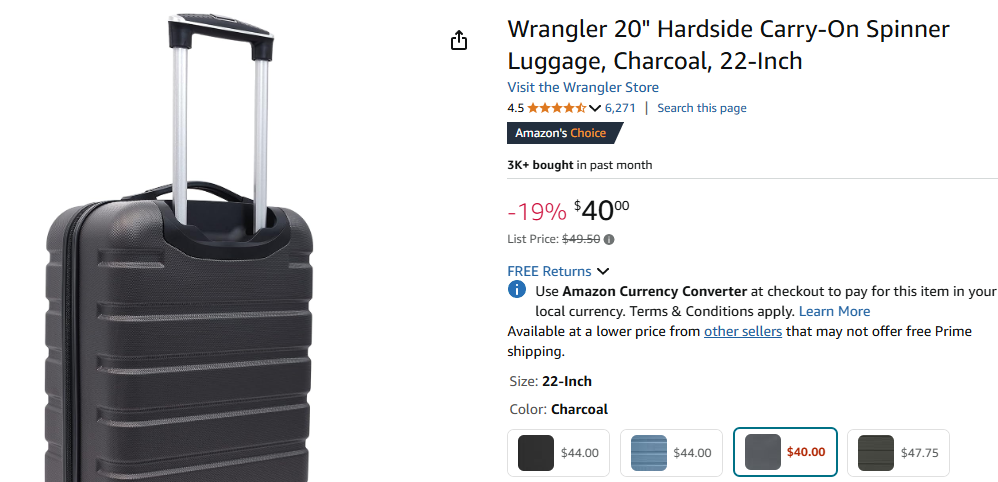

Some of the links on this site are affiliate links, which means I may earn a small commission if you click on them and make a purchase, at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases.