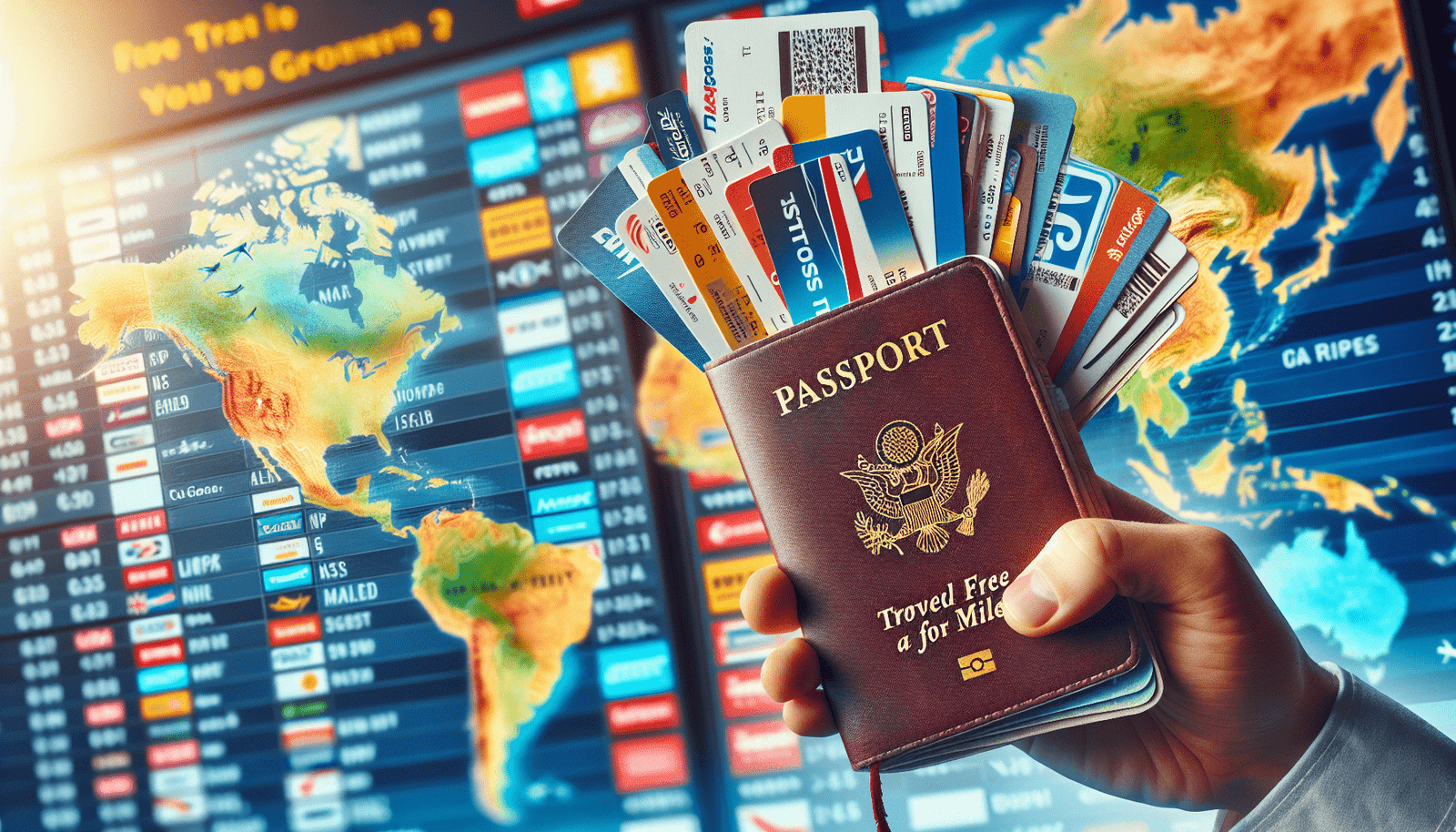

Picture yourself exploring your dream destinations without the worry of hefty travel expenses. That’s right; you could be jet-setting first class or indulging in five-star hotel experiences by unlocking the potential of travel credit card rewards. Years ago, the journey began with an ambitious collection of over 1.7 million points and miles, leading to a six-month adventure across Europe and Asia. And while such an extensive trip may not be everyone’s goal, imagine the thrill of a cost-free vacation once a year.

In this beginner’s guide, you’ll uncover the magic behind traveling for nearly nothing with points and miles. From learning the ropes of earning them through savvy credit card strategies to mastering the art of redeeming rewards for flights and luxurious stays, every step is covered. You’ll gain insights into important considerations like understanding your credit score, choosing the right card, and maximizing points with multiple users. Get ready to harness these tips for a truly affordable travel experience that takes you anywhere you’ve ever dreamed of visiting.

Introduction to Free Travel with Points and Miles

Picture yourself jetting off to far-off destinations without spending a dime on flights or accommodations. Sounds too good to be true? Not quite! The secret lies in strategically using points and miles to fund your travels. There’s an allure to traveling the world in comfort that many find irresistible. My journey began when my partner and I decided to quit our jobs, dreaming of a six-month adventure through Europe and Asia. By leveraging over 1.7 million points and miles that we had painstakingly earned, we were able to explore new horizons without depleting our savings. The experience taught us one invaluable lesson: understanding and utilizing travel rewards can transform fantastical trips into achievable realities.

The beauty of leveraging points and miles is their ability to unlock experiences that might otherwise seem out of reach. Whether it’s an upgrade to a first-class seat, a stay in a luxurious hotel, or simply cutting down on travel expenses, these rewards can provide tremendous value. By mastering the art of earning and redeeming points, you too can embark on extraordinary journeys that elevate your travel experiences without breaking the bank.

Understanding Credit Card Travel Rewards

Basics of Points and Miles Systems

When diving into the world of travel rewards, it’s essential to grasp the basics of points and miles. These rewards are essentially loyalty currencies awarded by airlines, hotels, and other travel-related companies to encourage customer patronage. They can be earned through various means, such as flights, hotel stays, or credit card spending.

Redeeming these points for travel perks requires an understanding of the specific rules set by the loyalty programs. For instance, airline miles can typically be used to book flights, while hotel points might allow for free or discounted stays. The value of points and miles, however, can vary, making it crucial to understand how to maximize their potential.

Key Steps to Earn and Redeem Travel Points

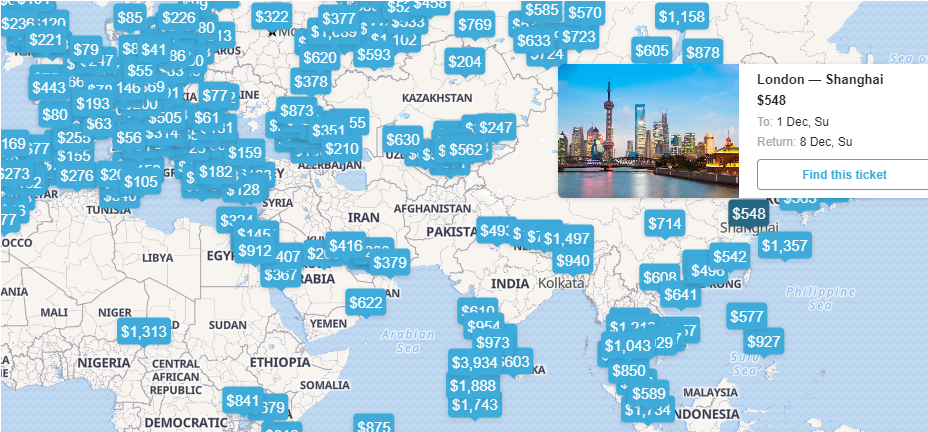

To start earning travel points, you need to explore and join various loyalty programs offered by airlines, hotels, or credit card companies. Each program has its unique structure, so understanding the offerings is vital. By strategically using credit cards that offer travel rewards, you can accumulate points with everyday purchases.

Redeeming points effectively involves researching the best ways to convert them into travel opportunities. This might mean booking flights or hotel stays through program portals or transferring points to partner airlines or hospitality chains. Being savvy about redeeming can save you significant costs on your travels, making it an essential step in the travel rewards journey.

This image is property of i.ytimg.com.

Importance of Credit Scores in Travel Rewards

How Credit Scores Impact Card Approvals

Your credit score plays a pivotal role in your ability to access travel reward credit cards. Most top-tier travel cards require a good to excellent credit score because they offer generous perks, which can be costly to provide. Lenders use your credit score to assess the risk of issuing you credit, as it reflects your financial reliability.

Without a strong credit score, you may struggle to qualify for these reward-rich cards. Thus, understanding and maintaining a good score will open up a world of potential travel rewards and benefits.

Maintaining a Healthy Credit Score for Benefits

A healthy credit score is maintained by several factors: timely bill payments, low credit utilization, and a well-managed mix of credit accounts. Remember to pay your credit card bills fully each month to avoid interest charges and maintain a solid payment history. Additionally, keep your credit utilization low by managing your outstanding balances.

Monitor your credit frequently and be mindful of how opening new accounts might affect it. With a favorable credit score, you’ll have access to more rewarding travel credit cards and thus bolster your ability to earn points and miles for future adventures.

Types of Points and Miles

Airline Miles and Their Advantages

Airline miles are perhaps the most well-known form of travel reward currency, typically tied to specific airlines or alliances. These miles can be used to book flights, often providing substantial savings on airfare. Additionally, utilizing airline miles might grant you access to upgrades, priority boarding, and free checked baggage, enriching your travel experience.

The advantages of airline miles include the ability to book tickets on partner airlines, which expands your travel opportunities. Understanding the redeeming value and blackout dates will ensure you get the most benefits from your accumulated miles.

Hotel Points and Loyalty Programs

Hotel points are equally valuable and can be redeemed for accommodation discounts, free stays, or room upgrades. Many international hotel chains offer loyalty programs that reward frequent stays with points, which can accrue over time for significant savings. These programs may also offer exclusive perks, such as complimentary breakfasts, late check-outs, or access to exclusive lounges.

By consistently staying at hotels within the same chain, you can maximize your point earnings and tap into the additional benefits offered by the loyalty program.

Transferable Points: Capital One Venture X Review

Transferable points provide considerable flexibility since they can be moved to various airline and hotel programs. The Capital One Venture X card is a stellar example, offering rewards that can be transferred to numerous travel partners. This flexibility allows you to utilize your points based on where they hold the highest value at any given time.

The card offers impressive rewards for travel-related purchases and features perks like travel credits and lounge access. By using a card with transferable points, you can enhance your reward strategy across different travel partners, tailoring them to your needs.

Fixed-Value Points for Flexibility and Control

Fixed-value points are another type of reward currency where points equate to a specific monetary value, offering predictable returns when redeemed for travel. This type of points system simplifies the reward process, making it straightforward to use points like cash for travel expenses.

These are particularly useful when bookings don’t fit neatly into an airline or hotel loyalty program’s offerings, providing the flexibility to book travel whenever and however you choose without worrying about fluctuating point values.

Methods to Earn Points and Miles

Capitalizing on Welcome Bonuses

Welcome bonuses are a quick and effective way to amass a significant number of points or miles. Many credit cards offer enticing bonuses when you meet a minimum spending requirement within the initial months of opening the account. These initial bursts of points can catapult you towards earning flights and stays much quicker.

Make sure to choose cards with achievable spending thresholds aligned with your regular financial activity to prevent overspending just to meet the requirements. Carefully selecting cards based on welcome bonuses is a strategic start to building your points repertoire.

Boosting Points Through Everyday Credit Card Spending

Everyday spending is another potent method of accumulating points and miles. By using your travel rewards card for regular purchases, you can significantly enhance your earnings over time. The key is to channel as much of your spending as possible through the card while maintaining disciplined repayments.

Some cards may offer bonus points for spending categories like groceries, gas, or dining. By aligning your card’s rewards structure with your spending habits, you can boost your point collection efficiently without altering your lifestyle.

Using Travel and Shopping Portals Effectively

Many credit card companies and loyalty programs offer online portals for shopping and travel bookings, where you can earn bonus points. Accessing your favorite retailers via these portals can sometimes mean earning one to several points per dollar more than you’d get with direct purchases.

To maximize this strategy, periodically check for portal promotions and align your big purchases with special earning events. This approach can supercharge your point accumulation efficiently, further strengthening your travel fund.

Creative Strategies to Maximize Rewards

Handling Large Purchases for Maximum Points

Large expenses, like home renovations or travel bookings, present perfect opportunities to earn a substantial number of points quickly. Consider using your travel rewards card for these large purchases where possible, but ensure you’re able to pay the balance fully to avoid interest.

Timing these purchases strategically with bonus promotions can further amplify your reward earnings, turning necessary expenses into amazing travel opportunities later down the line.

Adding Authorized Users for Collaborative Success

Adding authorized users to your travel rewards card can help accumulate points faster. Their spend contributes to your points without incurring higher fees, especially beneficial if they’re responsible spenders who’ll pay their share.

Make sure to monitor all transactions to maintain control over the account and ensure the additional spend aligns with maximizing your point-earning strategy.

Using Work Travel to Your Benefit

If you’re required to travel for work, consider leveraging this to boost your points balance. Use your personal travel rewards credit card for work-related travel expenses and later seek reimbursement from your employer.

Profiting from required travel ensures that your business trips also contribute to your personal travel rewards balance, turning your professional obligations into personal travel benefits.

Redeeming Travel Rewards for Maximum Value

Strategies for Redeeming Flights and Hotel Stays

Successfully redeem points for maximum value by comparing several redemption options, taking note of any blackout dates or restrictions. Utilize tools and resources available through loyalty programs or credit card sites to determine the most value-driven options for your points or miles.

Sometimes, redeeming points for hotel or flight deals may offer better value than standard redemption rates. Evaluating special promotions can lead to more affordable luxury experiences than you’d otherwise consider.

Evaluating Points Value and Transfer Partners

Understanding the value of your points is crucial for strategic redemption. Use point valuation guides to assess which transfer partners offer the best conversion rates. Moving transferable points to high-value partners maximizes their potential, ensuring you get the most from your hard-earned rewards.

Points valuations fluctuate based on market conditions, so staying informed about your options can ensure you always use your points where they’ll take you furthest.

Booking with Airlines and Hotels Directly

Direct bookings with airlines and hotels using points may also unlock additional benefits, such as upgraded seating or room options and minimized fees. This strategy allows you to sidestep potential issues seen with third-party booking platforms while tapping into direct customer perks.

Understanding each loyalty program’s rules will arm you with the knowledge to ascertain the best booking approach for your particular needs.

Choosing the Best Travel Credit Card

Assessing Cards Based on Credit Score Requirements

When you’re ready to select a travel rewards card, start by reviewing the credit score requirements for each. You want to target cards where your score aligns comfortably with their acceptance criteria, ensuring higher approval odds.

Research and compare options, noting the travel rewards, perks, and fees associated with each, to find one that addresses your travel needs and financial situation.

Importance of Welcome Bonuses and Minimum Spending

Welcome bonuses are a crucial factor when choosing a card. The size and achievability of the bonus should guide your decision, as well as how well it aligns with your spending habits. If the minimum spending threshold feels unreachable or forces you into excess spending, reconsider your selection.

Evaluate cards based on achievable welcome bonuses to build a solid foundation for your points earning journey.

Evaluating Annual Fees and Their Benefits

Annual fees are standard on many top-tier travel credit cards, but the benefits often offset them. Examine the benefits package, including lounge access, travel credits, and insurance, to weigh if the fee is justifiable compared to other card offerings.

Selecting a card with a fee structure that aligns with the benefits you value ensures you’ll extract maximum value from your card.

Maximizing Rewards with Two Player Mode and Business Cards

Steps for Cooperating with Multiple Users

Engaging with travel rewards as a duo, also known as two-player mode, can amplify your points-earning capabilities. When both you and a partner have complementary cards, the cumulative benefits and earning opportunities increase.

Strategize together to align card choices and spending habits, effectively doubling your rewards potential. Sharing responsibility and benefits helps in reaching travel goals quicker.

Exploring Business Credit Card Potentials

If you’re a business owner or freelancer, business credit cards present additional earning opportunities. These cards often feature categories aligned with business spending, allowing you to accrue points on regular business expenses.

The separate accounts can help manage personal and business finances more clearly while increasing your overall points earning potential across both categories.

Conclusion

Strategic use of travel rewards can transform your approach to exploration, making trips that seem financially daunting much more accessible. By navigating the intricate world of points and miles, you’re empowered to create value-driven vacations that don’t require deep pockets.

Harnessing the strategies outlined—earning, redeeming, and maximizing points through smart card use and planning—you’ll find yourself jetting off on adventures while safeguarding your financial well-being. Dive in with curiosity and determination, and soon you’ll be mapping out dream itineraries fueled by savvy travel reward practices.

Some of the links on this site are affiliate links, which means I may earn a small commission if you click on them and make a purchase, at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases.