Ryan Shirley shares an incredible journey in his video “Unlocking Passive Income with Ryan Shirley: How to Make Your Money Work for You.” Starting with a modest goal in 2019 to make $100 a day passively, Ryan quickly surpassed his target by the end of the year. He’s now bringing in a remarkable $3,000 monthly through various passive income streams. By sharing his experiences and strategies, Ryan hopes to inspire you to explore and cultivate your own passive income opportunities.

In the video, Ryan explains the fundamental shift from active income, where you trade your time for money, to passive income, where your money works for you. He highlights how platforms like YouTube, digital products, and affiliate marketing have been instrumental sources for his success. Ryan emphasizes starting small, identifying what works for you, and aiming for consistent growth. With insights from financial experts and his proven methods, you, too, can aim to increase your daily income while enjoying the freedom and benefits that passive income brings.

Understanding Passive Income

Defining Passive Income vs. Active Income

When considering how to earn money, it’s important to understand the difference between passive and active income. Active income refers to the money you earn in exchange for performing a service or completing a task, like working a nine-to-five job or freelancing, where your time directly correlates with the money you make. This type of income is the traditional form of earning, where labor equals payments, but it requires you to continuously work to maintain your earnings. In contrast, passive income is money earned with minimal ongoing effort, allowing your money to work for you rather than require your active involvement. Passive income streams often require upfront investments of time, money, or resources to create, such as renting out property, earning through dividends from stocks, or generating revenue from online content. It provides the potential for income while you sleep—truly making your money a working asset.

The Psychological Shift: Turning Money into a Working Asset

Adopting a passive income mindset requires a significant psychological shift. Instead of viewing money merely as a result of rigid labor linearity, you begin to see it as a tool that can generate more money. This perspective empowers you to create opportunities for compounding your wealth. The idea is not to stop working, but to work smarter instead of harder, investing time upfront for future benefits. Shifting your mentality from earning solely through time-bounded methods to generating income autonomously allows for not only wealth accumulation but also personal growth and freedom. It’s akin to planting a tree: the initial planting and watering require effort, but it grows and bears fruit with time, offering benefits long after the initial investment.

Why Create Passive Income Streams: Freedom and Flexibility

The allure of passive income lies in its transformative effects on your lifestyle, offering freedom and flexibility that active income seldom provides. By establishing multiple passive income streams, you unlock the potential to pursue passions, travel, or even take a break from traditional work without sacrificing your financial health. This type of income introduces a cushion against job insecurity, market fluctuations, or unexpected life events, providing peace of mind and the luxury of choice. The independence and financial security it affords make the pursuit of passive income not just a financial strategy, but a lifestyle evolution towards a more autonomous and fulfilling life.

Introduction to Ryan Shirley

Who is Ryan Shirley and Why Listen to Him

Ryan Shirley is a creative entrepreneur who has successfully harnessed the power of passive income, primarily through his YouTube channel and additional digital platforms. Known for his travel content and entrepreneurial spirit, Ryan began sharing his journey to financial freedom in 2019, inspiring others by turning his hobby into a viable income stream. His transparency about the ups and downs of passive income generation, combined with his practical advice, makes him a relatable and trustworthy figure in the financial community. Ryan’s journey serves as a testament to the potential of new-age media channels like YouTube to transform personal interests into successful business ventures.

Ryan’s 2019 Goal: $100 a Day in Passive Income

In 2019, Ryan set an ambitious yet clear goal for himself: to create enough passive income streams to earn $100 a day by the end of the year. At the time, he was barely making $3-$5 a day, but he ventured into this challenge head-on, leveraging his skills and creativity to flip the script on how his time and efforts translated into earnings. His determination and strategic approach to achieving this goal made him a formidable self-starter in the world of passive income.

From $3-$5 to $100 Daily: The Journey

Ryan’s journey from making only a few dollars each day to averaging $100 daily is an inspiring tale of growth and perseverance. By diversifying his income streams and adopting smart financial strategies, he gradually increased his earnings. This evolution was driven by not just his technical know-how but also by the confidence that small, consistent efforts accumulate into significant outcomes. Ryan’s success story is a motivating reminder that while the road to passive income may not be instantaneous, it is certainly achievable through discipline, learning, and adaptation.

Ryan’s Main Passive Income Source: YouTube

How YouTube Generates Revenue: Ads and Views

One of Ryan’s primary streams of passive income is his YouTube channel. YouTube monetizes content primarily through advertisements: creators earn when viewers watch or interact with ads shown during videos. The amount earned from ads depends on factors like the video’s niche, the demographics of the viewership, and the advertisers willing to pay to reach the audience. Additionally, the more views a video garners, the more revenue it generates, turning popular videos into ongoing income opportunities.

Keys to Ryan’s Success: Content Consistency and Engagement

The success of Ryan’s YouTube channel hinges on consistency and engagement. By regularly uploading quality content, he maintains audience interest and boosts his channel’s visibility in the YouTube algorithm. Engaging with viewers, understanding their preferences, and fostering a community around his content have been pivotal in building a loyal subscriber base. This consistent interaction not only drives more views and ad revenue but also positions his channel as a go-to source in its niche, naturally attracting more viewership over time.

Monetizing Creativity: Time Lapses and Stock Footage

Ryan leverages his creative skills by offering time lapses and stock footage as digital products. This not only monetizes the videos he creates but also capitalizes on content he’s already developed. These digital products provide value for fellow creators who might lack the resources to produce high-quality visuals themselves, creating a demand for his offerings. Such diversity in content monetization not only enhances Ryan’s revenue but also broadens his impact in the creative community.

This image is property of i.ytimg.com.

Exploring Alternative Income Streams

Digital Products: Selling Time Lapses and Stock Footage

Ryan’s use of digital products, like selling time lapses and stock footage, provides a valuable alternate stream of income beyond YouTube. By creating and selling these visual assets, Ryan taps into the needs of other creators and businesses seeking high-quality visuals for their projects. This approach epitomizes the concept of making creative content work harder and longer, generating income without needing to produce new content constantly.

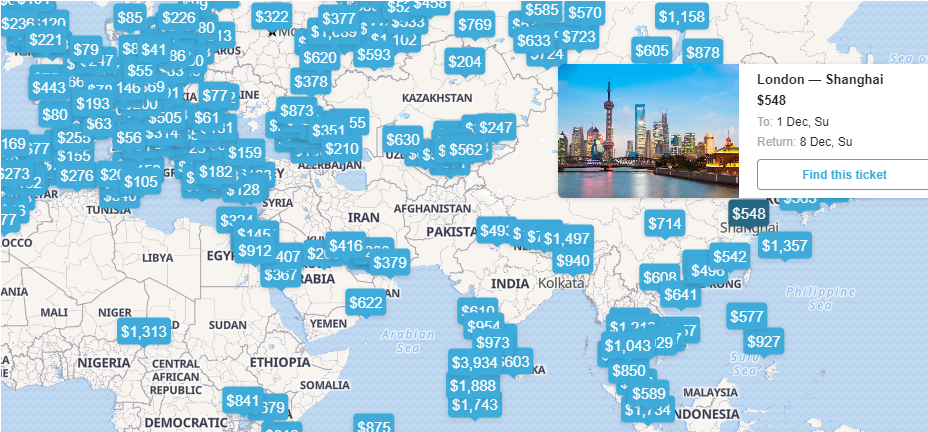

Thinking Beyond YouTube: Firework and Mox TV

To further diversify his passive income, Ryan explores platforms beyond YouTube, such as Firework and Mox TV. Firework allows users to share short, engaging video content, and Ryan repurposes segments of his longer YouTube videos here. He meets platform engagement goals and is rewarded financially for doing so. Similarly, Mox TV offers another outlet for his video content to reach a global audience, particularly in regions where it has a strong viewership, like Russia and Latin America. These platforms not only provide additional income avenues but also help Ryan tap into varied audiences worldwide.

The Affiliate Marketing Potential

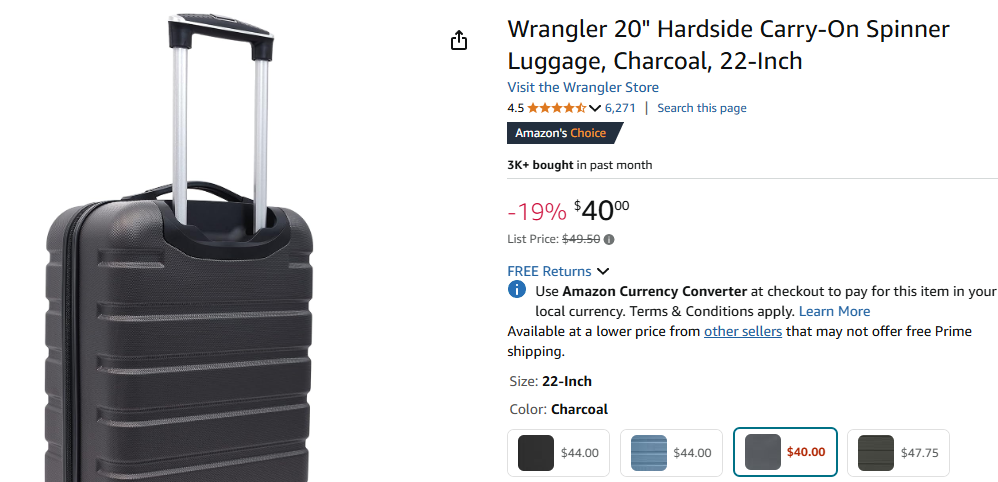

Affiliate marketing is another income stream Ryan has delved into, albeit modestly in the beginning. By recommending products he uses, such as camera equipment, and including purchase links in his content descriptions, Ryan earns a commission for each sale made through those links. While his earnings from affiliate marketing started small, there is significant potential for growth as his audience and influence expand. With more visibility and trust among his viewers, this stream could become a substantial addition to his passive income portfolio.

Passive Income and Travel: A Neat Combo

Turning Travel into an Investment

For Ryan, travel isn’t just a passion—it’s an investment. By incorporating his travel experiences into his content, he effectively turns his adventures into a financial asset. Every journey becomes an opportunity to capture new material for his channel, appealing to a wide audience interested in travel and exploration. This strategy maximizes the return on his travel expenses by turning them into engaging content that continues to generate revenue long after the trip ends.

Leveraging Travel Experiences for Content

Ryan’s travel experiences serve as rich fodder for his content creation. Whether filming breathtaking landscapes or capturing cultural nuances, his unique footage appeals to both travel enthusiasts and other content creators. This not only broadens his audience base but also enriches his digital product offerings, such as stock footage, contributing another layer to his passive income strategy.

The Role of Experiences in Creating Marketable Content

Experiential content is king for Ryan, as authentic and immersive experiences often translate into highly marketable and shareable material. His firsthand adventures provide a genuine insight, resonating well with viewers. By documenting personal experiences, Ryan crafts stories that captivate his audience, encouraging repeat visits to his content and expanding his digital footprint. This not only enhances viewer engagement but also ensures longevity in the potential revenue generated from each piece of content.

The Big Plans: Scaling Up Passive Income

Setting S.M.A.R.T. Goals: From $100 to $300 a Day

To scale his passive income further, Ryan employs the S.M.A.R.T. approach to goal-setting, ensuring goals are Specific, Measurable, Achievable, Relevant, and Time-Bound. By aiming to increase his passive income from $100 to $300 a day, he not only outlines a clear target but also creates a compelling roadmap for achieving it. This method of structured goal-setting is essential for maintaining focus and measuring progress, motivating him to explore innovative ways to diversify and enhance his income streams.

Investing Earnings Wisely: Stock Market and Real Estate

As part of scaling up his passive income, Ryan looks into investing his earnings wisely in the stock market and real estate. By putting his money into dividend-paying stocks or rental properties, he seeks to generate new streams of passive income, broadening his financial portfolio. These investments represent a step towards creating a sustainable and enduring financial framework, ensuring continued growth and security in his quest for financial independence.

Ryan’s Long-Term Vision: Financial Independence

Ryan’s long-term vision transcends just increasing daily earnings; it is about achieving financial independence. This vision is rooted in creating a robust financial foundation that supports his lifestyle regardless of active income sources. Pursuing financial independence means building wealth that allows him the freedom to choose how he spends his time, without being tethered by financial necessity. It’s about more than just accumulating wealth; it’s about ensuring lasting security and the ability to live life on his own terms.

The Experts Who Paved the Way

Learning From the Best: Graham Stephan and Andrei Jikh

Ryan draws inspiration and strategies from financial experts like Graham Stephan and Andrei Jikh, who have successfully navigated the realm of passive income and financial planning. These mentors provide valuable insights into effective methods for creating and managing multiple income streams. By learning from their successes and challenges, Ryan is able to apply proven strategies to his own financial journey, enabling steadier growth and diversification of his passive income sources.

Integrating Proven Strategies into Your Own Plan

Integrating proven strategies from experienced professionals into your financial plan can significantly augment your journey toward passive income. You can benefit from their lessons and apply their techniques to tailor your unique path. This approach not only accelerates learning but also minimizes common pitfalls, building a more solid foundation from which to launch your financial endeavors.

The Importance of Mentorship in Financial Growth

Mentorship plays a crucial role in financial growth, offering guidance, accountability, and real-world insights that are invaluable for anyone looking to achieve financial success. By seeking mentorship, you gain access to a wealth of knowledge and experience, which cultivates your ability to make informed decisions and navigate complex financial environments. This support system is vital for personal development and enhancing your tactical and strategic skills in managing passive income.

Actionable Steps to Start Your Own Passive Income

Identify Your Skills and Market Opportunities

To embark on your passive income journey, start by identifying your current skills and the market opportunities they align with. Recognize what you’re good at or passionate about and explore how these can be turned into viable income streams. Whether it’s creating digital products, offering online courses, or leveraging your expertise through consulting, there are myriad opportunities waiting to be tapped into by aligning your skills with market demands.

Content Creation as the Cornerstone

Content creation can serve as the cornerstone of a successful passive income strategy. Whether it’s through blogging, podcasting, or video content, sharing your insights, experiences, and knowledge can attract an audience that finds value in what you provide. Consistently delivering high-quality, engaging content builds a community around your niche, opening doors to monetization opportunities such as ad revenue, digital products, and affiliate marketing.

Experimentation: Start Small and Scale Over Time

Begin your foray into passive income by experimenting with small ventures. Starting small allows you to test ideas, learn from experiences, and refine your approaches without overwhelming risk. Gradually, as you gain confidence and traction, scale your efforts to increase your income streams. By iterating and adapting, you can strategically expand your operations and magnify your passive income potential.

Common Myths About Passive Income

Debunking ‘Get Rich Quick’ Misconceptions

One of the most pervasive myths about passive income is the ‘get rich quick’ notion. Many believe that passive income is an effortless, rapid route to wealth, which is far from reality. Achieving substantial passive income requires strategic planning, hard work, and perseverance. It’s not an instant windfall but a gradual buildup of income streams that, over time, can lead to financial stability and growth.

Understanding the Initial Effort Required

While passive income involves making your money work for you, it does not eliminate the need for initial effort. Significant time, resources, and dedication are required upfront to establish and nurture income streams. Understanding and accepting this necessity is crucial to lay a solid foundation for your passive income ventures, paving the way for long-term benefits.

Passive Income is Not ‘No Work’ Income

A common misconception is that passive income equates to ‘no work’ income, which misleads many aspiring earners. While it reduces the need for continuous active involvement post-establishment, it still requires management, optimization, and occasional upkeep. Recognizing the ongoing but limited effort necessary maintains realistic expectations and better prepares you for the passive income journey.

Conclusion

Why Starting Today Matters

Starting your passive income journey today is vital. The earlier you begin, the more time your efforts have to compound and grow, leading to potentially greater financial benefits in the future. Procrastination only delays the opportunity to leverage your time and resources, so taking your first steps now positions you ahead in the path to financial independence.

The Potential for Greater Financial Freedom

The potential for achieving greater financial freedom is significant when you invest in building passive income streams. It allows you to break away from the constraints of traditional earning paths, enjoy more personal time, and secure your financial future. By diversifying income sources and building a robust financial portfolio, you pave the way for a more secure and liberating financial lifestyle.

Encouragement to Explore and Experiment

You are encouraged to explore and experiment with various passive income avenues to discover what best suits your interests and skills. The journey is about learning, adapting, and growing as you navigate through different opportunities. With persistence and exploration, you can find the right combination of income streams that align with your financial goals and aspirations.

Some of the links on this site are affiliate links, which means I may earn a small commission if you click on them and make a purchase, at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases.