Before you consider applying for a travel credit card, exploring the best options tailored to your travel goals can offer incredible value. In this latest episode of the Travel Hacking for Beginners series with Nik and Allie from Away Together, you’ll uncover seven crucial factors that can help you maximize the benefits of travel rewards cards. The discussion ranges from understanding the importance of your credit score to navigating rules like Chase’s 5/24 policy and evaluating point currency types. They aim to steer you through a comprehensive strategy for tapping into the full potential of these cards while sharing hacks that promise to double your points.

Embarking on the journey of selecting the right travel credit card might feel overwhelming, but this guide makes it easier and more rewarding. Besides the basics, you’ll learn about the significance of welcome bonuses, minimum spending requirements, and annual fees, all key in shaping a financially smart choice. Additionally, insights into using business credit cards and strategies like the Two-Player Mode could further boost your points accumulation. Though credit card consultations are on pause, the episode serves as an engaging educational piece, providing entertainment and tips to fuel your travel adventures.

This image is property of i.ytimg.com.

Understanding Your Credit Score

Your credit score is a crucial aspect of your financial health, particularly when it comes to applying for travel rewards credit cards. It acts as a measure of your creditworthiness to potential lenders. A higher score generally increases the likelihood of being approved for credit cards that offer substantial benefits. Different cards have different credit requirements, so knowing your score helps you target appropriate cards.

Importance of Credit Score in Application Approval

Banks and credit card issuers view your credit score as a reflection of your financial reliability. This number helps them determine how likely you are to repay borrowed money. Typically, the most enticing travel rewards cards require good to excellent credit scores. If your score is lower than you’d like, you might miss out on cards with the best points, miles, and bonuses. Hence, staying informed about your credit score is pivotal for planning which cards to apply for.

Tools for Monitoring Your Credit Score

Several tools can help you monitor your credit score effortlessly. Platforms like Credit Karma provide free access to your credit reports and scores from TransUnion and Equifax, two of the three major credit bureaus. Regularly checking your score through such tools can alert you to any changes, helping you manage your debt and identify errors that might impact your score negatively. Maintaining awareness easily translates into proactive measures to improve your score over time.

How to Improve Your Credit Score Before Applying

Improving your credit score might require some strategic actions before applying for a new card. Start by ensuring timely payments on existing credit lines, reducing your debt-to-credit ratio, and not applying for multiple lines of credit at once to avoid too many hard inquiries. Also, review your credit report for inaccuracies that might be dragging your score down. Taking these steps ensures you present yourself as a more attractive applicant.

Navigating the Chase 5/24 Rule

In the world of travel rewards, understanding the Chase 5/24 Rule could significantly impact your strategy.

What is the Chase 5/24 Rule?

Chase Bank enforces an unofficial policy called the 5/24 Rule. Simply put, if you have opened five or more personal credit cards in the past 24 months, Chase will automatically deny your new credit card application, irrespective of your credit score or financial standing. This rule encourages strategic planning regarding how and when you open new lines of credit.

Strategies for Managing New Credit Card Applications

To navigate the 5/24 Rule effectively, be mindful of the credit cards you apply for within a two-year period. Prioritize Chase cards if they are on your list since getting locked out by this rule could restrict access to some highly valuable points. An astute approach is planning applications based on the card’s benefits and timing, maximizing your broader travel rewards strategy.

Prioritizing Cards Under the Rule

Given its significance, the Chase 5/24 Rule means prioritizing which cards to apply for first. Evaluate the rewards, point multipliers, and bonuses for Chase cards against others and apply strategically. Since Chase cards often offer transferable points, they can be foundational in building a flexible rewards portfolio.

Demystifying Point Currency Types

Understanding the types of points offered by different cards can enhance your ability to maximize value from rewards.

Understanding Different Point Systems: A Breakdown

Not all points are created equal. Different credit cards offer various types of points, such as airline miles, hotel points, or flexible points that can be transferred to multiple partners. For example, Chase Ultimate Rewards, Amex Membership Rewards, and Citi ThankYou Points are highly valuable due to their flexibility.

Valuing Points: What to Consider

Point valuations can vary, affecting how far your points will take you. Consider factors like transfer partners, blackout dates, and redeeming flexibility. Using resources like The Points Guy’s monthly valuations can give you a better understanding of how many cents per point a given currency might yield.

Choosing a Card for Maximum Point Usability

The choice of a card should align with your travel goals. If you value flexibility, a card with transferable points across airlines and hotel chains might serve you best. Conversely, if you’re dedicated to a specific airline, its co-branded credit card might offer superior value through status upgrades or free checked luggage.

Maximizing Welcome Bonuses

Understanding how to leverage welcome bonuses can significantly bootstrap your points collection.

Timing Your Application for Best Results

Timing plays a crucial role in maximizing welcome bonuses. Often, credit card offers fluctuate, with elevated bonuses appearing during certain periods. Aligning your application with these favorable times—often coinciding with new quarter promotions or holidays—can bolster your starting points balance.

Understanding Promotional Fluctuations

Promotional fluctuations can catch you off guard if you aren’t paying attention. Subscribing to alerts from forums or following travel bloggers can keep you updated on when a card’s sign-up bonuses are at their peak, supporting strategic timing.

Leveraging Bonuses to Meet Your Travel Goals

Welcome bonuses are often designed to cover hefty travel expenses. Carefully align your travel plans with periods when you’ve amassed these bonuses. Whether it’s a long-haul flight or a luxurious hotel stay, using these bonuses intentionally matches your spending to your personal travel aspirations.

Meeting Minimum Spending Requirements

Meeting spending thresholds without overspending is key to unlocking those lucrative welcome bonuses.

Aligning Spend with Personal Habits

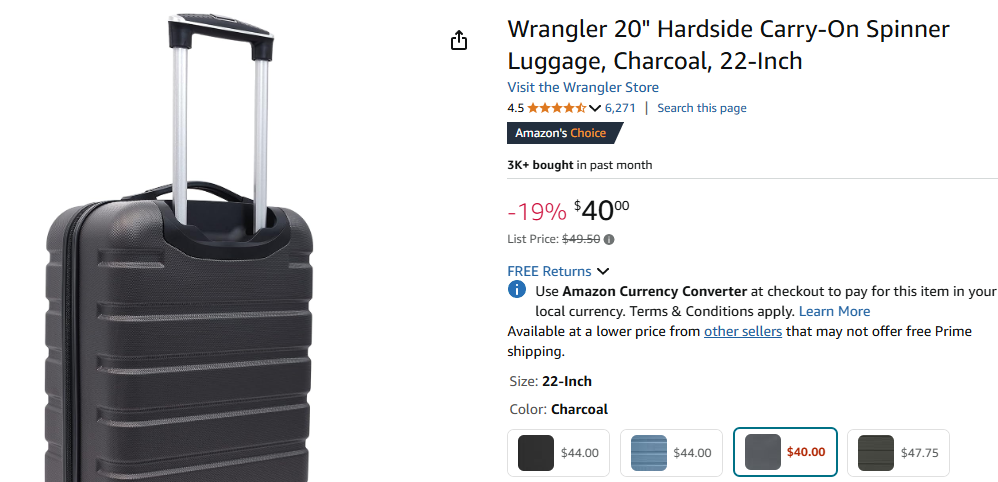

Successfully navigating minimum spending requirements calls for aligning necessary and planned expenses with these thresholds. By adjusting your spend to fit into what you’d be paying anyway—such as bills, groceries, or even planned big purchases—you can meet these targets without additional financial strain.

Creative Spending Strategies

Unlocking bonuses requires strategy. Some creative ways include using your card for bills normally paid by check or adopting a “two-player mode” strategy with a partner to split larger expenses over both cards. Being mindful not to incur unnecessary debt while doing so is essential.

Potential Pitfalls to Avoid

The lure of sign-up bonuses can lead to reckless spending. Be cautious of overspending just to hit requirements. What might seem manageable could lead to financial strain down the line. Keeping spending practical and within budget ensures that the bonus’s benefits won’t be overshadowed by accrued debt.

Justifying Annual Fees: Are They Worth It?

Annual fees on credit cards can be intimidating if not evaluated against offered benefits.

Evaluating Card Perks Versus Cost

Determining if a card’s annual fee is justified requires a close look at its perks. Some cards offer value back in travel credits, airport lounge access, or statement credits on purchases, which can quickly outweigh the cost. Assessing how these align with your normal spending and travel habits is key.

Long-Term Benefits of Higher-Fee Cards

Higher-fee cards typically offer enhanced benefits for loyal users. Over time, perks such as premium traveler perks, improved point-earning potential, and higher-tier status with airlines or hotels can justify the expense. Weighing these against long-term travel goals provides clarity on value.

Assessing Your Personal Travel Needs

Ultimately, the suitability of a card’s annual fee correlates with how well its benefits match your travel needs. A frequent flyer might find the fee an investment, given the perks and savings, while a casual traveler may find a no-fee card preferable.

Understanding Card Suitability

Choosing a card tailored to your lifestyle and financial capability maximizes benefits.

Choosing Between Personal and Business Cards

Personal and business credit cards serve differing purposes. While personal cards might suit regular consumption, a business card can track expenditures separately and provide different reward structures or higher limits. Evaluate your situation to choose appropriately.

Special Situations: Two-Player Mode

The “two-player mode” involves strategic coordination with a partner to manage card applications and spend. This technique amplifies point earnings and helps maximize bonuses across two card accounts for double the value, especially useful for shared travel plans.

Tailoring Your Card Choice to Travel Dreams

Your dream destinations and travel preferences heavily influence the ideal card. An airline-loyal card is valuable for domestic frequent flyers, while a transferable points card optimizes international travel with diverse airline partnerships.

Advanced Hacks for Doubling Points

In travel rewards, doubling points is a game-changer.

How to Utilize ‘Two-Player Mode’

In ‘two-player mode,’ partners work together, applying for different cards to maximize household point earnings. This approach not only increases bonus captures but also takes advantage of referral bonuses when applicable, propelling your points balance ahead more quickly.

Exploring the Benefits of Business Credit Cards

Business credit cards can serve a dual purpose by managing personal and business expenses separately while offering unique perks suitable for corporate or self-employed individuals. These cards often offer higher spending limits and unique bonuses that enrich your total rewards strategy.

Maximizing Points with Household Efforts

Combining household purchases enables families to consolidate spend, meeting spending requirements more effortlessly and collectively stacking rewards. Shared strategies boost point acquisition without deviating from normal budgets.

Leveraging Travel Card Resources

Adept use of card resources and travel tools can further stretch your rewards.

Alternative Tools for Matching Credit Cards

Various online tools and resources allow for easy credit card comparison, enabling you to find the best card aligns to your credit profile and travel goals. Tools like a ‘card match’ service can identify pre-qualified cards without hard pulls.

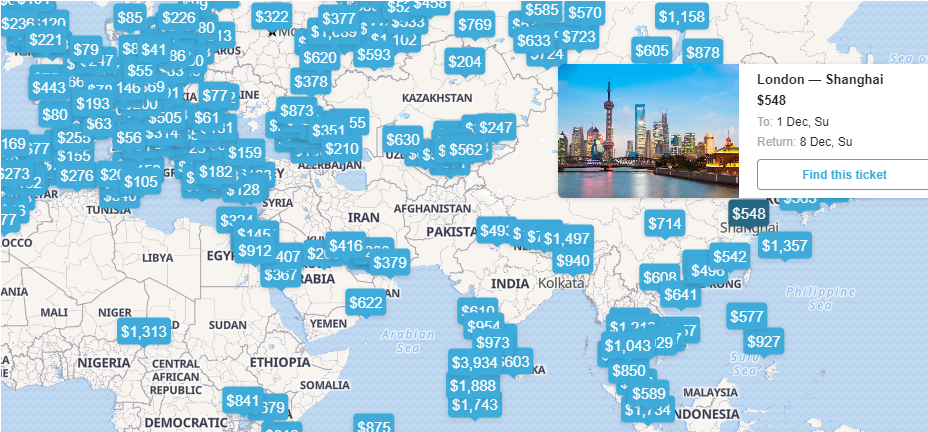

Free Resources for Travel Planning

E-sims for flexible travel communication, universal adapters, and packing lists are essential resources that can aid in seamless travel experiences. Leveraging free online tools like flight finders helps maximize travel plans.

Tips from Travel Hacking Experts

Learning from seasoned travelers and leveraging their insights optimizes your use of points and miles. Influencers often share tested strategies and tips for avoiding common pitfalls, keeping your travel rewards journey smooth.

Concluding Thoughts

Making Informed Decisions for Financial Stability

Understanding the nuances of travel credit cards empowers you to make informed financial decisions, ensuring that the benefits outweigh costs. By strategically maximizing points and bonuses, you can achieve financial stability and enhance your travel experiences simultaneously.

Staying Updated Amid Changing Offers

Credit card offers are continually evolving, affected by market trends and competitive pressures. Staying proactive by regularly reviewing card benefits and updates ensures you remain ahead in leveraging offers.

The Impact of Points and Miles on Your Travel Experience

When wielded wisely, points and miles drastically cut travel expenses and open up experiences that might otherwise be out of reach. Used strategically, they transform travel opportunities, unlocking luxury experiences and more extensive travel horizons.

Some of the links on this site are affiliate links, which means I may earn a small commission if you click on them and make a purchase, at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases.